NEW YORK – An exchange-traded fund (ETF) that tracks some of the largest multistate operators (MSOs) fell nearly 17 percent during the first two weeks in March amid rumors of dissension within the ranks at the Drug Enforcement Administration (DEA) that could derail cannabis rescheduling.

According to a recent report in The Wall Street Journal, some DEA officials refuse to let go of antiquated beliefs that cannabis’s “medicinal benefits remain unproven and that it has a high potential for abuse,” people familiar with the matter told the Journal. Others within the agency reportedly are concerned about the increasing potency of THC and rescheduling’s potential impact on international treaties like the 1961 Single Convention on Narcotic Drugs.

Whether DEA administrator and ultimate rescheduling decision-maker Anne Milgram holds any outdated opinions about cannabis is anyone’s guess, but it should come as no surprise that some within the agency wish to maintain the status quo when it comes to drug policy. The DEA’s most recent “fact sheet” from 2020 reads like 1950s propaganda with euphemisms like dope, grass, and Aunt Mary and copious warnings about physical dependence and withdrawal. On the positive side, the fact sheet acknowledges “[n]o deaths from overdose of marijuana have been reported.”

During a recheduling review requested by President Joe Biden last year, the U.S. Department of Health and Human Services (HHS) determined cannabis has currently accepted medical uses and a lower potential for abuse than other drugs and substances listed in Schedules I and II of the Controlled Substances Act. (Cannabis currently resides on Schedule I.) Legal experts and members of Congress also have repeatedly debunked any potential treaty concerns.

On Thursday, HHS Secretary Xavier Becerra doubled down on his department’s conclusions during a Senate Finance Committee hearing after Sen. John Cornyn (R-TX) suggested the recent federal rescheduling review was inadequate and less thorough than previous iterations.

“There has been a lot of science that’s been collected over the years on cannabis. We have far more information now,” Becerra said. “What we’re doing is simply reflecting what the science is showing.”

Cornyn also questioned Becerra about why his department compared cannabis to heroin for abuse potential instead of other scheduled substances.

“I’m going to try not to speak directly for the [Food and Drug Administration] because the FDA did this assessment analysis independently from HHS,” said Becerra. “They are the agency that has been tasked with that job with their scientists and I won’t try to speak for them. But what I will tell you is that the rigorous work that was done to come to these conclusions was based on the science and the evidence they had before them.”

In January, Becerra said his department continues to offer the DEA any “follow-up, technical information” as needed. The FDA is a department of HHS.

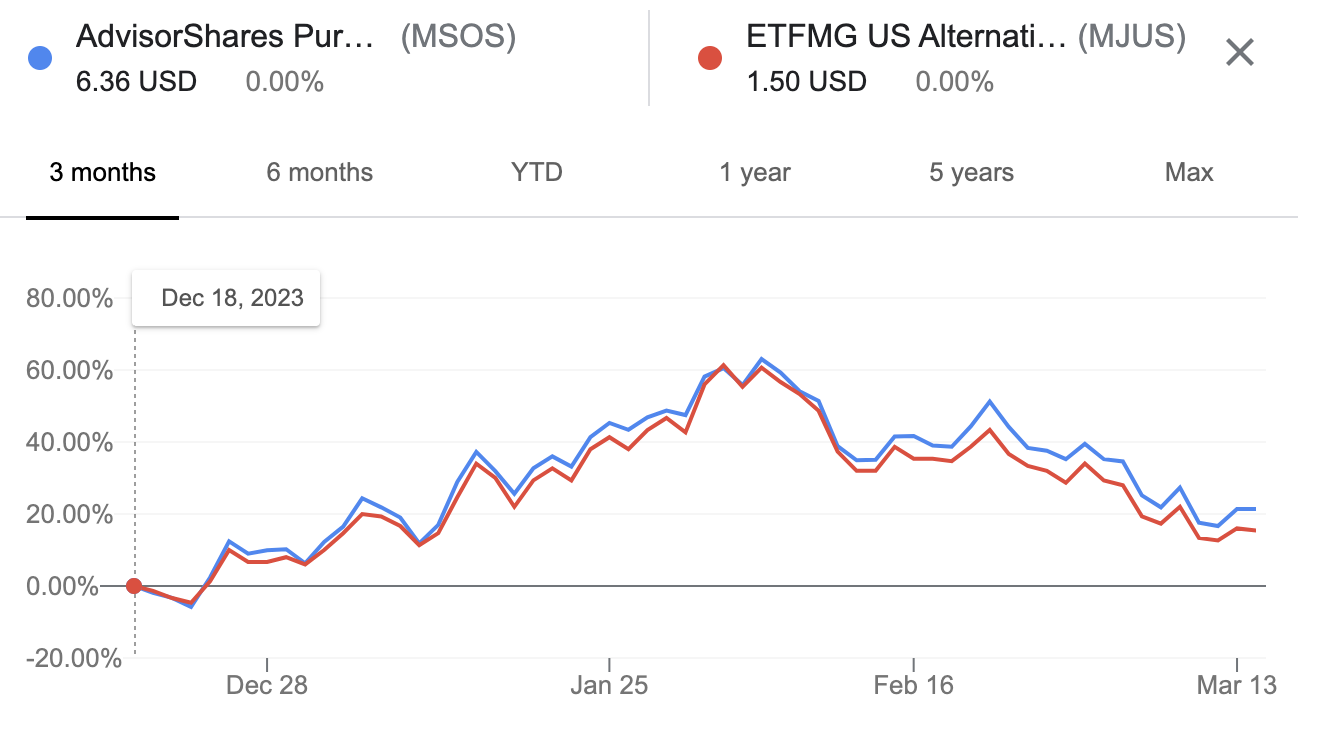

The share price of MSOS, a United States cannabis ETF, recovered slightly by mid-March to a share price of $7.72. However, the index is down 26 percent from its peak of $10.37 in early February after weeks of positive momentum.

According to Viridian Capital advisors, the growth through 2024 was “primarily created by false rumors of imminent rescheduling announcements and the portfolio rebalancing by the MJUS ETF.” The MJUS ETF seeks long-term growth by investing in U.S. cannabis companies and treasury bills. Trends for the two ETFs appear quite similar over the past six months.

If anything, the volatility of cannabis-related stocks illustrates the power potential rescheduling has on investors’ perceptions. While Viridian analysts have predicted a dozen MSOs would save $700 million annually with the 280E relief rescheduling likely would deliver, companies including Green Thumb Industries, Verano Holdings, and Trulieve topped revenue estimates for the fourth quarter of 2023 without changes in federal policy.

Be the first to comment