Darren415

I wrote about Ascend Wellness (OTCQX:AAWH) in early November, saying it was no longer the cheapest MSO. The stock was trading at just $1.00 then, and it now trades much higher. I like it, though! To be fair, I liked it then too, but I was concerned that it wasn’t as cheap to its peers as it had been.

In this follow-up, I review the Q4 and 2023 financial results, discuss the outlook and how it has changed, take a look at the chart and assess the valuation. Hopefully, the analysis that I am sharing will explain why AAWH is currently 19% of my Beat the American Cannabis Operator Index model portfolio and now 6% of my Beat the Global Cannabis Stock Index model portfolio. I added it last week, including a purchase on Friday at $1.30.

Ascend Wellness Improved in 2023

Ascend Wellness grew net revenue by 28% in 2023 to $518.6 million. The gross margin fell from 33.1% to 29.9%. Fortunately, its operating expenses expanded only 12%, aided by the lack of a settlement expense. Removing the $5 million charge from the 2022 results, operating expenses expanded by 16%. Adjusted EBITDA for the year expanded by 14% to $106.5 million. One of the biggest improvements was in cash flow from operations, which expanded to $75.3 million from -$38.4 million in 2022. Capital spending was$24.2 million, meaning that the company generated free cash flow. For 2024, the 10-K of the company included a forecast of capital spending of $35-40 million.

I like that Ascend Wellness isn’t in as many states as many of the other MSOs, as it gives them a chance to expand or to be potentially acquired by a larger MSO. Many investors fail to appreciate that several states limit the operators. Some restrict the number of dispensaries, and some put a cap on the size of the cultivation facilities.

Ascend, based in NYC, operates in Illinois, Maryland (no cultivation), Massachusetts, Michigan, New Jersey, Ohio and Pennsylvania. It is at the limit of 10 dispensaries in Illinois, and it endured some challenges in 2023 due to the Missouri legalization for adult-use. Two of its stores were near the Missouri border and benefitted from tourist purchases.

Helping Ascend in 2023 was the New Jersey legalization for adult-use, which was implemented in April of 2022. It expanded by acquisition in Maryland, which extended from medical to adult-use. Ohio is set to legalize for adult-use, and Pennsylvania may do so as well.

One thing that I don’t like about Ascend and many of its peers is that they have substantial debt but negative tangible book value. I think that the debt could be difficult to refinance. Ascend ended 2023 with net debt of $236 million. Its tangible equity was -$126.1 million.

The Ascend Wellness Outlook Has Brightened

Ahead of the Q4 report, analysts, according to Sentieo, were expecting 2024 revenue to be $576 million. They were forecasting adjusted EBITDA of $121 million. Now, the analysts are expecting revenue to grow 11% to $576 million still, but they project adjusted EBITDA will grow 17% to $124 million. The growth projected this year is higher for Ascend Wellness than its peers, as the average revenue growth for the Tier 1 and Tier 2 names is just 4.5%, and Ascend has the highest projected growth of these companies. Ascend has the second-highest projected adjusted EBITDA growth, and it is well above the average of 10%.

Two of the nine analysts were projecting 2025 revenue of $589 million with adjusted EBITDA of $139 million. Now five analysts expect revenue to grow 7% to $617 million.

Ascend Wellness Has an Attractive Chart

AAWH is up 29.5% so far in 2024. This is a bit ahead of the New Cannabis Ventures Global Cannabis Stock Index, which has gained 26.0% thus far. AAWH was not part of that index during Q1, but it has joined for Q2 due to higher trading volume.

Compared to MSOs, Ascend is trailing. The NCV American Cannabis Operator Index, which includes it and a dozen other MSOs, is up 34.9% in 2024 through Q1.

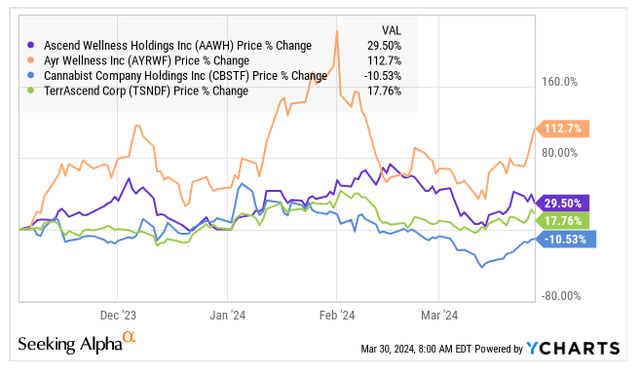

Looking at the performance of Ascend relative to the 3 other Tier 2 MSO names since early November, it has trailed AYR Wellness (OTCQX:AYRWF) substantially. It has outpaced the other two:

YCharts

I like Cannabist (OTCQX:CBSTF), which sold a convertible note recently that weighed on the stock. I wrote positively about TerrAscend (OTCQX:TSNDF), but I no longer include it in either of my model portfolios.

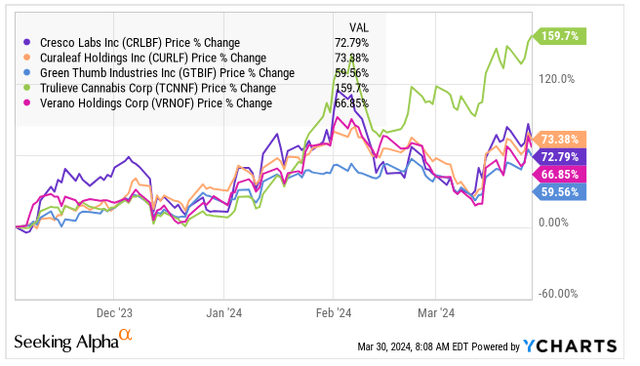

Looking at the larger peers, the 5 Tier 1 names have all done much better than AAWH since 11/3. The very worst name has returned more than twice as much as Ascend Wellness:

YCharts

AdvisorShares Pure US Cannabis ETF (MSOS) has rallied 70.2% since 11/3. Then, the ETF owned no AAWH. Now, it owns 1.9 million shares, which is just 0.2% of the total fund. It first bought over 1 million shares in early February, when the stock was much higher than it is now.

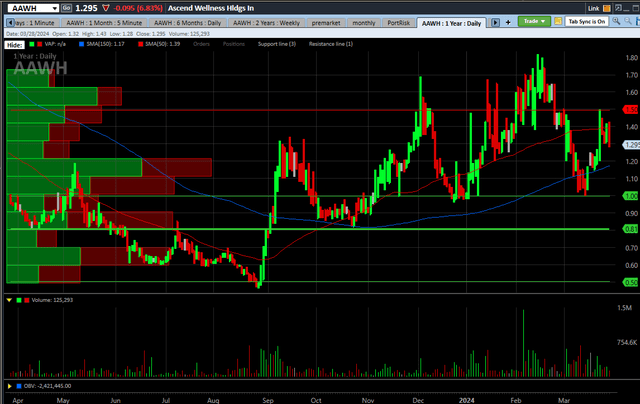

I think the chart of Ascend is attractive, as it shows higher lows and higher highs, with very high volume recently:

Schwab

The big spike in volume in early February is likely related to the purchase by MSOS, but the volume has remained relatively elevated.

The stock posted an all-time low in late August just ahead of the potential rescheduling news. It peaked in February and pulled back to $1.00, which looks like solid support for now. For now, I see $1.50 as potential near-term resistance.

Taking a look at the past two years, the stock is still down substantially:

Schwab

Since the end of 2022, the stock has rallied only 12.6%, substantially less than the 45.3% gain in the American Cannabis Operator Index.

Ascend Wellness Is Cheap to MSO Peers Again

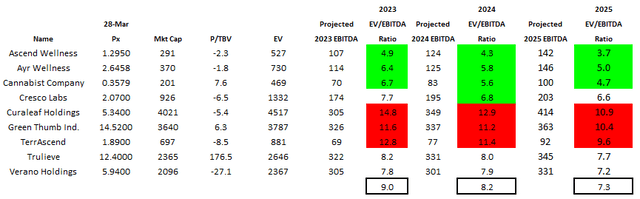

In November, I pointed out that Ascend, while cheap, no longer stood out like it had in the past. It had an enterprise value to projected adjusted EBITDA for 2024 ratio of 3.7X, the second-lowest of the 9 Tier 1 and Tier 2 companies. The average for the group at that time was 5.5X.

Here is the updated data for both 2024 and also 2025:

Alan Brochstein, using Sentieo

For 2024 estimates, Ascend is now the cheapest at 4.3X. The average is now much higher than before at 8.2X. The AAWH estimates have increased, though less than its price. Its peers, though, have seen decreases in their adjusted EBITDA estimates and much higher prices.

For 2025, Ascend is also the cheapest at just 3.7X. The average is 7.3X, If cannabis is rescheduled to Schedule 3, then the 280E tax will be eliminated. This would be a very good thing for the MSOs, and it could allow valuations to expand.

Ahead of the Q4 report, I shared a set of year-end 2024 targets with members of my investing group. My optimistic target, assuming 280E goes away, was $3.89, and my pessimistic target was $0.78. Updating those targets using the same metrics, I now get an optimistic target, based on an enterprise value of 8X projected 2025 adjusted EBITDA, of $4.00. This would be a rally of 209%. My pessimistic target, based on a decline to 3X, would be $0.84, representing a potential decline of 35%. This is a lot better than its peers.

Conclusion

Ascend has rallied a lot since early November, but it has rallied less than its MSO peers. The stock looks relatively cheap to them. How rescheduling plays out will highly impact its return, but I like it enough to include it in my model portfolios.

I have discussed the attractive chart and the cheap valuation relative to peers. It is now in the Global Cannabis Stock Index that I am trying to beat in my model portfolio, and I am a bit overweight relative to that index.

The biggest risk to AAWH and its peers is if 280E does not go away. AAWH has a negative tangible book value and substantial debt, as I have discussed, and these would pressure the stock. Another risk is that Pennsylvania, expected by many to move beyond medical cannabis to adult-use, does not do so.

Two weeks after I wrote the piece on Ascend, I reiterated my bullishness on Trulieve (OTCQX:TCNNF), which was then $5.61, up from the $4.775 price when I assessed Ascend. It has more than doubled! I recently downgraded TCNNF to a “Sell”. I think AAWH is a great substitute for TCNNF, which has less upside and more downside than Ascend Wellness.

So, while I am not much of a fan at this time of the MSOs due to my fear that investors have gotten overly excited about something that may not happen, I rate this MSO as a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment