The recent decision by the DEA to reschedule cannabis to Schedule III has triggered notable volatility in the market valuations of multi-state operators (MSOs).

According to Viridian Capital Advisors’ latest weekly credit report, the MSO index surged by 25% immediately after the announcement, indicating a strong initial market reaction. However, this enthusiasm quickly faded, with the index dropping by 15% the following day.

These shifts are significant as they influence the perceived financial health of these companies, judged by their market value and their ability to manage their debts.

MSOs Adjust To DEA Rescheduling

How are these shifts reflected in the financial trajectories of major MSOs? According to Viridian Capital Advisors’ analysis, several MSOs are navigating different financial paths post-DEA rescheduling.

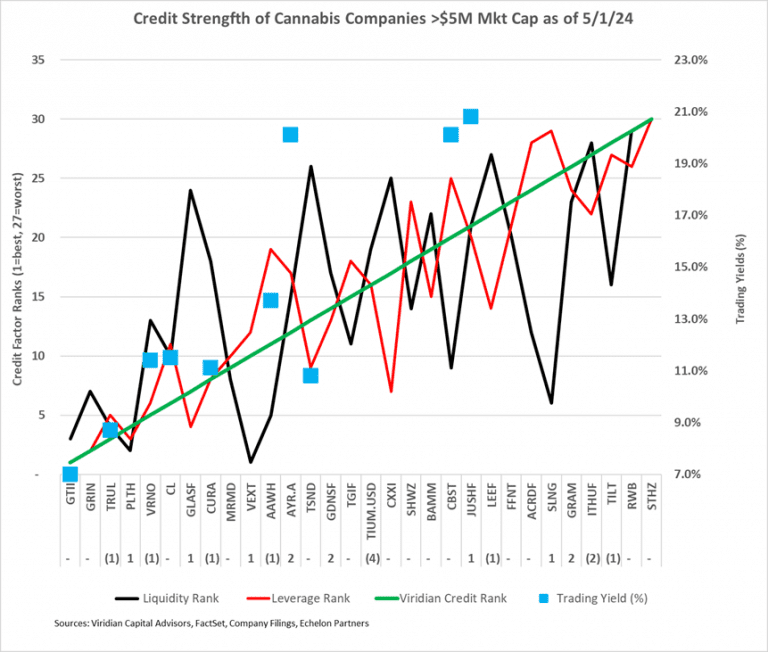

Green Thumb Industries Inc. (GTI) (OTC:GTBIF) has secured a deal promising a 7% return by April 2025, a notably high rate. This favorable arrangement boosts GTI’s position in Viridian’s credit rankings, though at a cost higher than that of its industry peers.

In contrast, Trulieve’s (OTC:TCNNF) current yield stands at 8.7% with a 380 basis point over the curve, suggesting a potentially more balanced risk-return profile.

Meanwhile, companies like Verano (OTC:VRNOF), Cresco (OTC:CRLBF), and Curaleaf (OTC:CURLF) are trading yields in the 11-11.5% range, highlighting varying degrees of risk and investment attractiveness.

Ascend Wellness: High Yield, High Risk

Ascend Wellness Holdings, Inc. (OTC:AAWH) emerges as a particularly interesting case. Despite a high yield of 13.7% on its $275M first lien term loan due in August 2025, its high liabilities relative to market cap—approximately 83% of its total valuation—may be restraining stock performance.

Additionally, Ascend’s complex market position and diverse geographic presence pose challenges for potential acquisitions. According to Viridian, addressing its upcoming debt maturity proactively could significantly improve its financial standing and market valuation.

Understanding how recent changes affect credit rankings and valuations is just the beginning. Join us at the 19th Benzinga Cannabis Capital Conference in Chicago this October 8-9 to discuss these developments in depth. Engage with top executives, investors, policymakers, and advocates to gain insights into the future of the industry. Secure your tickets now before prices increase by following this link.

Photo: AI-Generated Image.

Be the first to comment