Cannabis stocks are up a lot this year, but they are still down a ton over the past three years:

The New Cannabis Ventures Global Cannabis Stock Index, which currently has 29 members, is at 10.18, up 25.5% year-to-date. It has dropped 13.1% since April 30th. That was the day the market rallied sharply on news that the DEA was planning to move cannabis from Schedule 1 to Schedule 3.

Today, the DEA recommendation was published. It is not a done deal, but this is real progress. I have been following this industry closely for more than 11 years, and I called out the importance of removing 280E taxation at the end of 2022. If this move to Schedule 3 takes place, it will indeed wipe it out.

Again, it’s not a done deal, and if 280E remains, things will be terrible. They already are! American cannabis companies are drowning in debt with very poor cash flow and stock prices that are down a lot from early 2021. For those who want to invest in cannabis, there are lots of different ways. The main ones I focus on at 420 Investor are American operators (“MSOS”), Canadian LPs and ancillary companies. This is not an exclusive list, as the index is only 36% MSOs, 31% ancillaries and 23% Canadian LPs. There are some other parts of the market!

I have been offering a model portfolio for my subscribers since I launched 420 Investor back in 2013. That model portfolio is currently up about 33% in 2024, which is better than the index. I currently hold 9 different cannabis stocks, include 4 American cannabis operators (42% of the model portfolio), 3 ancillaries (32%) and 2 LPs (26%). My cash level is just 0.5%. I don’t try to time the market! My goal is to have a portfolio that offers the best ideas for those who want to be invested in cannabis.

Why Buy?

Cannabis stocks are very beaten up. They are not all dirt-cheap, that’s for sure, but many are. The four MSOs that I own include three that are actually down in 2024 so far. Looking at the ancillaries, I think that they will do a lot better if 280E goes away. They don’t pay that tax, but their customers do! The two Canadian LPs I include in my model portfolio both trade below tangible book value.

The reason to buy is to make money! I think that risks remain, but we have a lot of opportunity with stocks way cheaper than they used to be. I am finding good risk-reward trade-offs.

What to Avoid

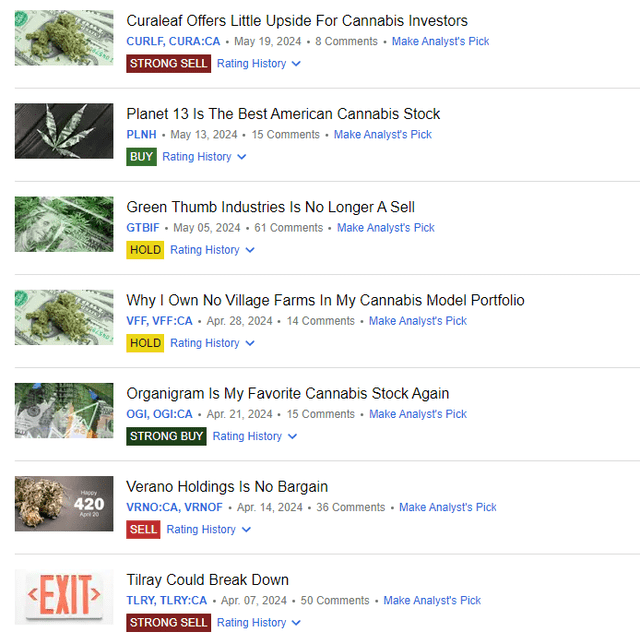

While I like a lot of cannabis stocks (especially the 9 that I include in my model portfolio!), there are some I really don’t like. These include Canopy Growth (CGC) and Tilray Brands (TLRY) among the Canadian LPs and especially Curaleaf (OTCPK:CURLF) among the MSOs. In fact, all of the very large MSOs kind of scare me, including Trulieve (OTCQX:TCNNF) and Verano Holdings (OTCQX:VRNOF). I have written my views publicly on each of these companies. There are many more companies that should be avoided!

Learning More

If you are interested in the cannabis sector, I think your timing is good. The elimination of 280E is a fantastic thing that is long overdue. Rescheduling won’t do much else, and many folks incorrectly believe that the exchanges, which do not allow American cannabis operators to list (both the NASDAQ and the NYSE), will start permitting it. It is their choice not to do so, and I don’t think that they will quickly begin. As I wrote in late 2022, this is the other big thing for cannabis stocks, so I hope that it happens.

I follow 23 cannabis stocks very closely on my Focus List. My subscribers at 420 Investor get updated on them frequently, as I share any news releases as they happen. I also provide previews of the quarterly financials for each as well as reviews of the filings. I share 10 videos per week where I discuss the charts and anything important in terms of news or valuation. I also update the model portfolio very frequently. The service hosts chat-rooms for each of the companies as well as a few other topics. Each week, I share three written weekly updates on Fridays, and I share a monthly update too in the 420 Investor Newsletter. 420 Investor subscribers get the three feature articles in each monthly newsletter as they are composed during the month.

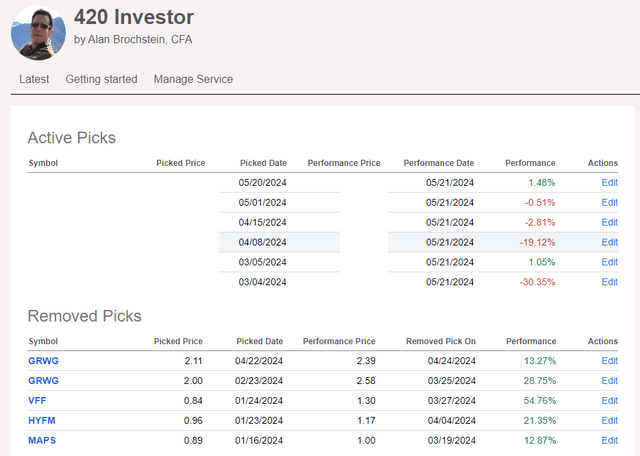

This year, I launched a sub-service of 420 Investor called The Big Picture. It is more appropriate for many people, and it costs less too. It doesn’t offer as much, but it does include that monthly newsletter as well as a weekly update. Importantly, it also includes Top Picks, which I began this year. I currently have 6 open picks, and I have closed five so far:

You can learn more about 420 Investor as well as The Big Picture and potentially subscribe. I also offer weekly articles that are free of charge:

Good luck to you! Good luck to the cannabis industry!

Be the first to comment