strelov

The stocks of the US cannabis operators were soaring on Friday, with the popular MSOS ETF (NYSEARCA:MSOS) up around 10%. With the Drug Enforcement Administration (‘DEA’) undergoing a review of the United States Department of Health and Human Services’ (HHS) recommendation to reschedule cannabis, there have been no shortage of headlines for the sector. However, today’s price action appeared more sharp than usual as some of the headlines appeared to carry more weight. In this report, I dissect the various headlines, review the significance of rescheduling, and discuss my top picks in the sector.

Why Are Cannabis Stocks Rising Today?

There were a handful of potential reasons why cannabis stocks were soaring today. First, HHS Secretary Xavier Becerra made comments on Capitol Hill on Thursday in favor of following the “science.” Today, Vice President Kamala Harris held a meeting with cannabis pardon recipients where she called on the DEA to reschedule cannabis “as quickly as possible.”

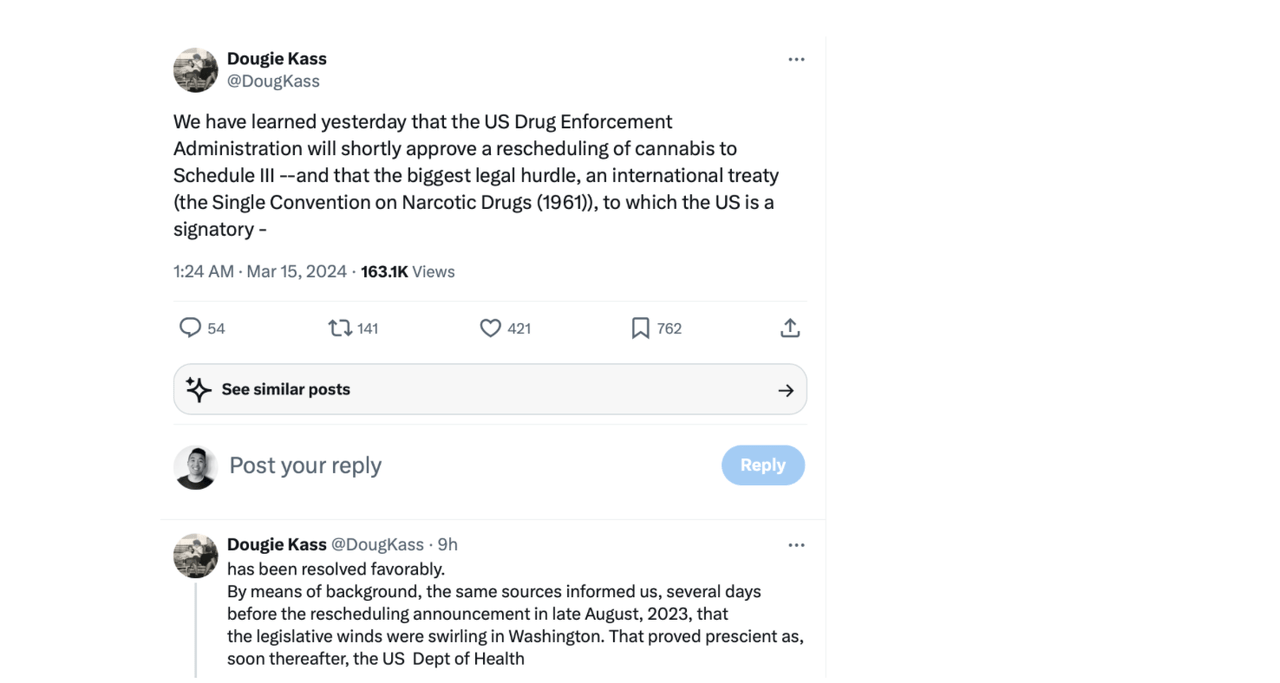

But in my view, the most significant driver of today’s rally was not from any official headline but instead from various tweets sent from famed investor Dougie Kass of Seabreeze Capital Partners where he notes that his sources have advised that the DEA will “shortly approve a rescheduling of cannabis to Schedule III.”

In another one of his tweets, he references the following exchange from an Ask A Pol reporter with Senator Cory Booker.

ML: “Have you heard anything about DEA and the administration moving?”

CB: “I have heard a lot about it.”

ML: “I’ve heard rumors that it might be April 15th — have you heard that?”

CB: “I do not want to comment on that.”

Booker laughs as he hops onto the elevator with his aide.

ML: “Ooooh — I’m warm?”

CB: “Yes…”

Confusion as elevators are shutting and people shuffling past.

CB: “…you didn’t say ‘420.’”

ML: “Right? Have a good one.”

CB: “Huh?”

That exchange appears to suggest an accidental acknowledgement that rescheduling of cannabis may be on the way. We obviously cannot confirm Kass’ sources, but it is hard not to share some of the optimism.

Why Rescheduling Matters For Cannabis Stocks

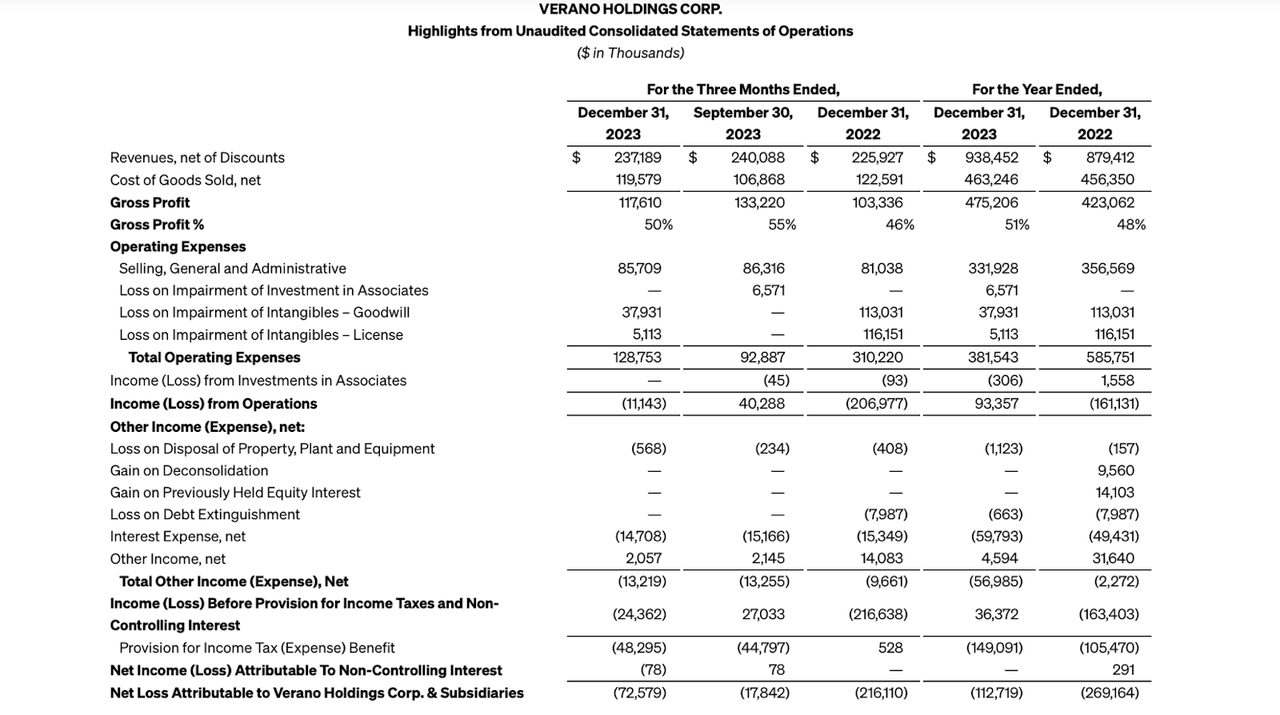

There are real reasons for this rally. US cannabis operators are unable to deduct operating expenses from the calculation of taxable income. It may be easier to look at a real example. We see below the income statement for top operator Verano Holdings (OTCQX:VRNOF):

2023 Q4 Press Release

We can see that the company recorded $149.1 million in income taxes in 2023 in spite of only generating $36.4 million in income before provision for income taxes. Management estimates that the removal of 280e taxes, which may occur upon rescheduling cannabis to Schedule III, would have saved the company over $80 million in taxes in 2023. Rescheduling cannabis to Schedule III, while falling short of decriminalization, may lead to a sudden surge in cash flows as well as declining costs of capital for these operators.

Best Cannabis Picks

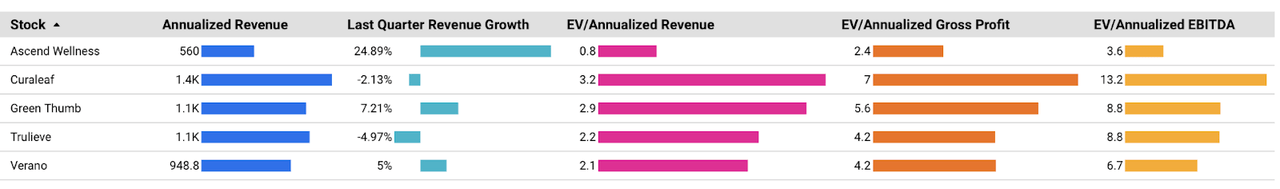

Let’s now discuss how to potentially invest in this upcoming catalyst. Green Thumb Industries (OTCQX:GTBIF) is always a notable pick due to its GAAP profitability and reasonable valuation. Trulieve (OTCQX:TCNNF) trades at similar valuations and may offer exposure to potential adult-use legalization in its home state of Florida. One can also look to the smaller operators like Ascend Wellness (OTCQX:AAWH), which tend to trade at sizable discounts relative to the larger operators.

Cannabis Growth Portfolio

I expect the stocks of the MSOs to fare well in the event rescheduling is passed. That said, I continue to prefer instead investing in the cannabis landlord NewLake Capital (OTCQX:NLCP), a net lease REIT which is smaller than its more well known peer Innovative Industrial Properties (IIPR). NLCP yields 9.4%, has no net debt on its balance sheet, and stands to see its tenants’ credit profile improve dramatically upon rescheduling. In my view, NLCP offers upside exposure to rescheduling while also representing solid value even in the event that rescheduling does not take place.

Conclusion

With so much enthusiasm in the cannabis sector, it bears reminding that many of these operators have high leverage on their balance sheets and may do poorly in the event that rescheduling does not occur, as they grapple with the consequences of the higher interest rate environment. Traders might appreciate the catalyst-driven setup for cannabis stocks, and I emphasize that one does not need to invest in the operators themselves to get exposure to such upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment