dvulikaia

Today is April 20 and it’s widely known as a day to celebrate cannabis. For investors, it might be a critical turning point in the fate of US-based stocks. The cannabis investing community has been anxiously waiting for potential regulatory reform, especially prospects for the Drug Enforcement Administration (‘DEA’) to reschedule cannabis to Schedule III, which would likely have significant implications. In this report I discuss my views on the cannabis sector, focusing on the MSOS ETF (NYSEARCA:MSOS), including where I am finding the most promise today amidst a slew of potential state-level legalization efforts. Cannabis stocks remain risky and may not be everyone’s cup of tea, but there’s real reason for hope for a sector that has been through the woodshed over the past several years.

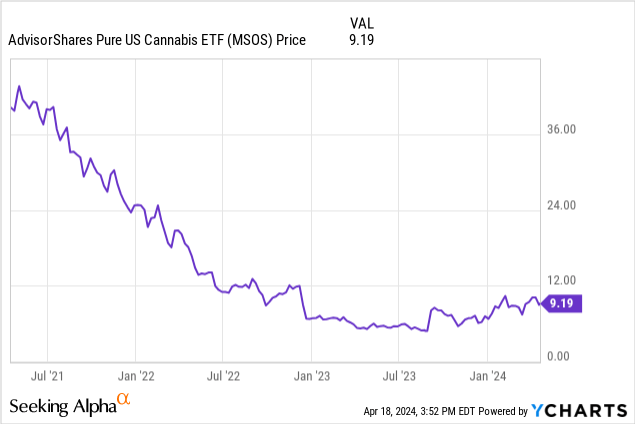

MSOS ETF Price

I last covered MSOS in March where I explained why I was bullish on the ETF given increased optimism for real federal reform. The ETF is roughly flat since then and has slightly outperformed the broader market by a low single-digit percentage – a seemingly rare feat for this typically volatile fund.

I expect volatility to increase substantially in either direction after this upcoming weekend.

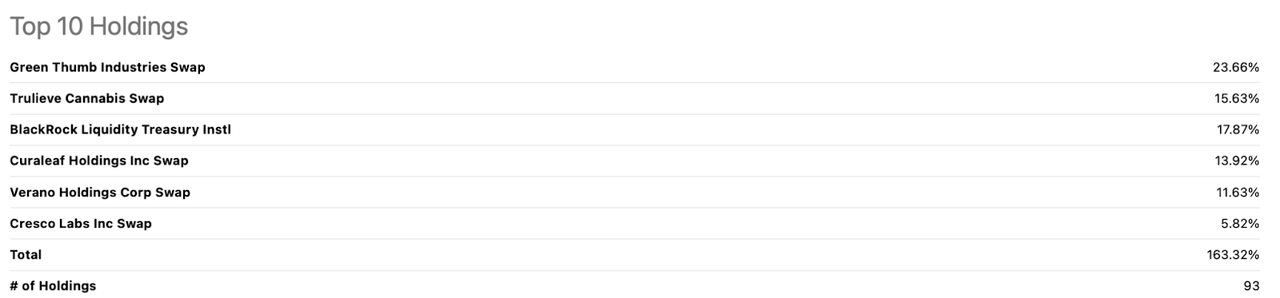

MSOS Stock ETF Holdings

The MSOS ETF is actively managed and has in general focused its holdings in the stocks of the multi-state operators (‘MSOs’), which is understandable given the fund ticker.

Seeking Alpha

The ETF is highly allocated to the largest names, including Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF), Curaleaf (OTCPK:CURLF), and Verano (OTCQX:VRNOF). I note that the percentages in the diagram above might look wonky but is mainly due to the fact that MSOS does not own these stocks directly, as US cannabis stocks in general trade over-the-counter whereas MSOS trades on the NYSE. Due to cannabis being illegal on the federal level, there are more stringent restrictions placed on these companies and their stocks. MSOS has been able to trade on the major exchanges mainly due to it owning “total return swaps” in the stocks, a clever loophole to offer institutional investors a more liquid way to invest in these names.

Will Cannabis Stocks Go Up In 2024?

Why is this year’s 4/20 day so significant for investors? As readers know, 2024 is the year of federal elections, which can coincide with major political developments. The most urgent development is that of the potential for rescheduling cannabis to Schedule III. The HHS has previously sent a recommendation letter to the DEA stating their view that cannabis should be rescheduled. It is unclear exactly when the DEA might respond, but in a recent update, White House Press Secretary Karine Jean-Pierre has stated that the review is with the Department of Justice, potentially implying some progress. Investors may be hoping that April 20th might end up being “the day” that we get good or bad news on rescheduling efforts.

Recall that rescheduling cannabis to Schedule III might boost the financial results of cannabis operators due to potentially removing so-called “280e taxes.” US-based cannabis operators are unable to deduct neither operating nor interest expenses from the calculation of taxable income, meaning that they are essentially paying taxes based on gross profits. This has often led to operators paying significant tax burdens in spite of generating negative taxable income.

Is Cannabis Legal In Florida?

Even if we do not get any news this weekend, it is possible (if not likely) that we eventually receive news later this year. Even so, I caution that cannabis stocks are likely to be volatile if we do not receive any news, as some investors might have initiated positions solely based on an April 20th news release.

There are more reasons to be excited for cannabis stocks than rescheduling efforts, however. As the Cannabis Business Times reports, there are potentially 11 states that could make progress towards legalization this year. The one state which I believe investors should focus on is the state of Florida. Cannabis stocks, especially those with significant operations in Florida, had seen their stocks rise following news that the Florida Supreme Court would allow the adult-use ballot measure to be placed on the November ballot. There had previously been fears that the Supreme Court would reject the proposed ballot measure, as they did in 2021. While early polls indicate that there might not be enough support to fulfill the 60% threshold requirement, I hold the view that these polls might not prove accurate given that such a meaningful issue is likely to bring out far more voters than expected. Florida is potentially such an important market due to its large flow of tourism (totaling around 120 million annually) and its limited license model, which has afforded operators more consistent profit margins. Moreover, adult-use legalization in the state can arguably be even more significant than removal of 280e taxes for certain operators, as only the former might have direct impact on EBITDA.

Investment analyst Pablo Zuanic has generously published his analysis of the potential boost to Florida operators. He bases his analysis on the commonly referenced estimate of a $6 billion total market – one shared by TCNNF management. TCNNF, the largest operator in the state, might see a 127% jump in revenue and 148% jump in EBITDA. Cansortium (OTCQB:CNTMF), the publicly traded operator with the most concentration in the state, might see a 156% jump in revenue and 134% jump in adjusted EBITDA. Other operators with operations in the state, including VRNOF and CURLF are also expected to see some benefit though not to the same degree.

Top Picks In US Cannabis Stocks

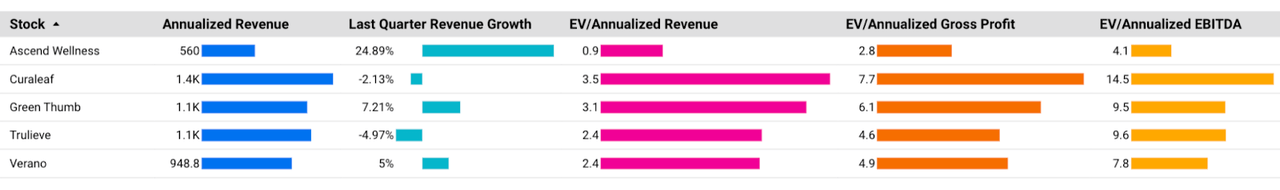

We can see a small snapshot of some valuations in the sector below.

Cannabis Growth Portfolio

As seen above, Ascend Wellness (OTCQX:AAWH) trades at a pronounced discount to larger peers on an EV/EBITDA basis and that relative undervaluation might afford it greater upside torque. Among the larger operators, I now favor TCNNF due to it having the greatest exposure to potential adult-use legalization in Florida. My top overall pick among cannabis operators is the aforementioned CNTMF which is most nearly a pure-play pick on Florida adult-use legalization (I note that CNTMF is higher risk as it is a penny stock). If CNTMF can command an 8x EBITDA multiple and execute upon estimates for a post-legalization world, then the stock might trade at $1.58 per share, implying considerable upside to the current $0.20 stock price. Finally, I continue to find the stock of NewLake Capital (OTCQX:NLCP) attractive. NLCP is not a cannabis operator but is instead a net lease REIT focused on the sector. The stock has rallied along with the sector but is still attractively valued at a 9.3% dividend yield while maintaining no net debt on its balance sheet. I note that the MSOS ETF does not have any allocation to NLCP nor its larger peer Innovative Industrial Properties (IIPR). NLCP might not see any direct financial benefit from reform efforts, but any improvement in tenant credit quality may lead to multiple expansion.

Conclusion

This weekend might prove pivotal for cannabis stocks if we are welcomed with positive news on whether cannabis might be rescheduled by the DEA to Schedule III. Looking beyond rescheduling efforts, I am of the view that potential adult-use legalization in Florida is a more significant catalyst than rescheduling for Florida-based operators. I have offered several potential picks with exposure to these catalysts. I suspect most investors might find the MSOS ETF to be a convenient way to trade these exciting developments in the sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment