Darren415

At the very end of 2023, I explained why Organigram (NASDAQ:OGI) was my favorite cannabis stock. It still is! The stock is up a lot this year, and my ownership in my model portfolio of a 19.5% stake is not the way I usually operate. I haven’t held the stake the full year, as I exited the name in March. It’s better to be lucky than smart, and I was very lucky, as the company surprised the market (and me) by selling stock. The stock pulled back, which is normal, but the pullback accelerated when Tilray Brands (TLRY) reported its fiscal Q3 and plunged.

I am not surprised by how much Tilray has retreated. My most popular article on Seeking Alpha since 2014 was my write-up just in advance of that financial report, when I explained why I expected the stock could break down. Again, my target is below $1, which would be an all-time low for that stock.

In this piece today, I explain why I like the stock of Organigram so much. I review the fiscal Q1 report from February, discuss the capital raise, update the analyst outlook, look at the chart and review the valuation.

A Look at the Organigram FY23 Q1

The company changed its fiscal year end by a month during its Q4, which made that month a 4-month quarter. Going into the Q1 report for the quarter ending 12/31/23, I was a bit concerned that the quarter, with its normal length, would look weak sequentially. I had no position in my model portfolio at the time. It had been 20% of the model portfolio at the beginning of the year, and it had rallied 74%.

According to Sentieo, analysts were projecting revenue of C$38 million with adjusted EBITDA of -C$1 million. On 2/13, the company reported that it had generated revenue of C$36.5 million, down 16% from a year ago. Adjusted EBITDA, though, was better than expected at C$0.1 million. This, though, was down a lot from the year-ago level of C$5.6 million. In fiscal Q4, the company had generated an adjusted EBITDA loss of C$2.4 million. Despite the revenue shortfall, the company generated positive operating cash flow. The C$7.7 million was a big improvement from the C$3.5 million.

The 10-Q revealed the source of the weakness in revenue: international. Adult-use grew slightly from a year ago (before taxes), while international sales plunged from C$5.9 million to C$1.0 million, all in Australia. The company has historically shipped to Israel, and it did ship its first German export in fiscal Q2.

The balance sheet understated the cash at C$41.8 million, as the additional investment by British American Tobacco (BTI) didn’t close until fiscal Q2. This buy added a similar amount. The tangible book value, adjusted for this additional investment, was C$288.7 million. BTI will be making additional investments at C$3.22, which is a premium to the current price and is above tangible book value per share.

I bought this dip in my model portfolio and held a large position until March.

Organigram Raises Capital Selling Stock

On March 27th, the company announced that it had sold C$25 million of its stock units, selling 7.7 million shares at C$3.23 with 3.85 million C$3.65 warrants. When it closed the deal on 4/2, it revealed that the underwriters had exercised the option and boosted it to 8.9 million shares with 4.45 million warrants, raising a total of C$28.75 million.

It wasn’t expected that the company, with lots of cash and no debt, would raise additional capital. I am well aware of the capital constraints in the industry and thought it was smart to sell stock above tangible book value and up a lot in price. The deal was priced at a discount to the price of C$3.65 on 3/26. It bottomed out a week or so after the deal at C$2.72, just below the C$2.75 low on the day the deal was announced. This represented a big discount to the deal price that more than made up for the inclusion of the warrant in my view. I liked too that it was a penny higher than the price BTI had paid recently and will pay again! I started buying this dip too, and boosted it after the TLRY disaster.

The Analyst Outlook for Organigram Hasn’t Changed Much

Ahead of the fiscal Q1 report, analysts were projecting FY24 revenue of C$166 million and FY25 revenue of C$189 million. They were expecting adjusted EBITDA would be C$6 million in FY24 and C$16 million in FY25. Only 2 of the 6 analysts were providing estimates for FY26, which is still the case.

The company not only reported its fiscal Q1, but it also held an analyst day two weeks ago. The analysts are still looking for FY25 revenue to be C$189 million with adjusted EBITDA of C$16 million. Their outlook for FY24 has increased to revenue of C$178 million with adjusted EBITDA of C$13 million.

The outlook for FY26 seems too strong, as analysts are expecting revenue to grow 46% to C$277 million. They project adjusted EBITDA will soar to C$44 million. The company hasn’t provided guidance, and my own outlook for the purposes of valuation is lower. I am assuming revenue growth of 25%, which would be C$236 million, and an adjusted EBITDA margin of 15%, which would be C$35 million.

The Organigram Chart Looks Promising

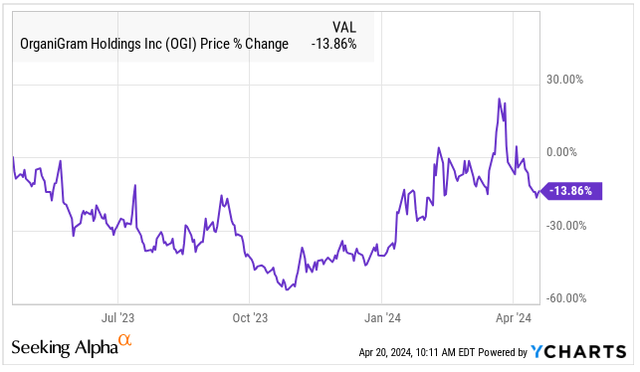

Organigram is up a lot in 2024, and it’s up a lot since the multi-year low set in 2023, but the stock is down over the past year:

YCharts

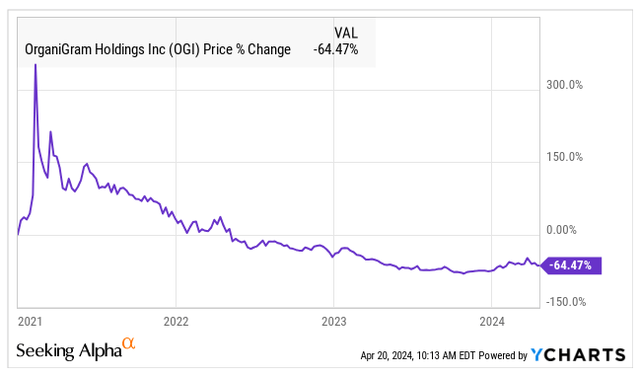

Of course, it’s down a lot more since BTI first invested in early 2021:

YCharts

The 64.5% decline since the end of 2020 is a smaller loss than the 78.6% loss in the New Cannabis Ventures Global Cannabis Stock Index.

Compared to peers Canopy Growth (CGC), Cronos Group (CRON) and Tilray Brands (TLRY), has done better since the end of 2022. The closest is CRON, which is down slightly less, while TLRY has dropped 79.1% and CGC has lost 96.8%. Over the past year, Cronos Group has outpaced Organigram, but Canopy Growth and Tilray have declined more.

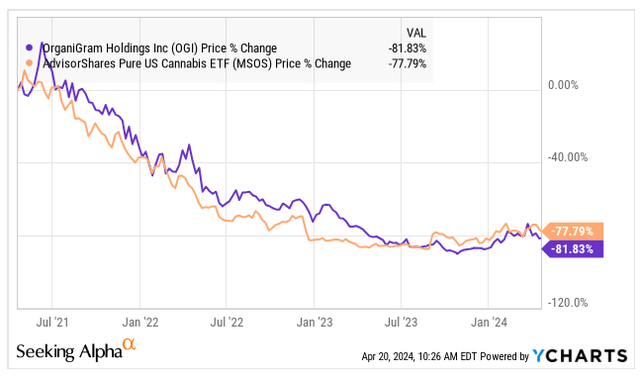

I continue to view AdvisorShares Pure US Cannabis ETF (MSOS) negatively, but it is very popular with cannabis investors. While it is focused on something very different from what Organigram is developing, I think the chart of OGI vs. MSOS is interesting. Over the past year, MSOS is up 61% on the rescheduling hopes. Looking back, though, OGI is down slightly more over the past 3 years:

YCharts

OGI has cash and no debt. MSOS is 88% invested in six MSOs with generally negative tangible book values and lots of debt. I view OGI as a lot better investment than MSOS right now, though if cannabis is rescheduled from Schedule 1 to Schedule 3, the onerous tax 280E would be eliminated. I think this could boost MSOS in the short-term if and when it happens.

Looking at the six-month chart of OGI, I think that the chart looks promising:

Schwab

There is an open gap created on 3/27 by the equity offering. I see resistance above that at $2.75. I see support near $1.60, which is where the 150-day moving average is currently and is also the high from the high-volume day when BTI announced the additional investment.

Organigram Is Cheap

When I wrote at year-end, my target for the end of 2024 was based on 12X enterprise value to adjusted EBITDA, which worked out to be U.S. $2.00 then. Now, there is more cash due to the equity raise and the additional purchase by BTI. My target then was not even 1X tangible book value.

The stock currently trades with a market cap of C$284 million at the price of C$2.61.The current enterprise value is about C$180 million. This works out to be 13.8X the projected adjusted EBITDA for FY25. For a federally legal company, this seems potentially low. It is also just 0.9X tangible book value, which is very low considering cash and no debt.

My year-end target is now based on a slightly higher multiple than I was using at year-end and is 15X. I am using 25% of the FY26 outlook (my outlook, which is lower than the analysts) and 75% of the FY25 outlook. This works out to an enterprise value of C$311 million. A market cap of C$415 million would be C$3.81, which works out to US$2.77. This represents a potential gain of 46%.

BTI seems to like Organigram. It’s difficult to assess whether or not they will acquire the company, but this could lift it above my target. I think that this possibility and the low tangible book value as well offer investors some downside protection.

There are some risks in Organigram too. Canada is maturing. The taxation there remains very high, and this may not improve. The company is expanding internationally, and the company may struggle. The Quebec acquisition seems like it has worked out well, but cash-rich companies can waste their cash on bad acquisitions.

Conclusion

The cannabis market is not in a new bull market, in my view. Typically, I would avoid big winners like Organigram has been, rising 44.3% so far in 2024. But, taking a longer look shows that OGI is way down from not only where it was trading, but from where BTI invested in early 2021. It’s also trading below where BTI recently invested more and will be buying more directly from the company soon. I think the valuation looks good, and I am encouraged by the discount to tangible book value.

For investors looking for stocks that are working, Organigram is working. For those who prefer stocks that have dipped, well, Organigram has had a big dip. It’s my favorite cannabis stock right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment