Nikolay Ponomarenko

In mid-February, I wrote about Planet 13 (OTCQX:PLNH) ahead of its Q4 report, discussing why I liked the stock, which was then $0.65. A lot has happened since then, but the stock is down a bit. I have a very large position in both of the model portfolios that I share with the members of my Investing Group. In this follow-up, I review the events so far in 2024, which include M&A, the Q4 and Q1 financial reports, and a capital raise, assess the outlook, take a look at the chart, and I discuss the valuation.

2024 Has Been Busy for Planet 13

The company reported Q4 in March and then Q1 this past week. The stock has a single analyst, but this analyst no longer provides quarterly estimates. Q1 revenue was $22.9 million, which was flat sequentially and down 8% from a year earlier. Operating expenses fell, and gross margin was about the same as a year ago. The loss from operations fell from $4.4 million to $3.7 million despite the slower business. The adjusted EBITDA improved from -$1.3 million to breakeven. Cash flow from operations in Q1 was better than a year ago, but the company did use $1.4 million. Planet 13 ended Q1 with net cash of about $20 million and tangible book value of $96.5 million.

Planet 13 has made a big move in Florida, selling its old license (that it bought from Harvest ahead of the Trulieve merger) and buying VidaCann, which was announced after the close on 5/10. VidaCann had previously agreed to merge with Cresco Labs (OTCQX:CRLBF), but the two companies terminated that merger in 2019. That deal was cash and stock-based and was for about $120 million. Planet 13 announced the VidaCann deal in August as mainly a stock-based transaction. The price has increased since then, and the company described the cost as $63.4 million at closing. It issued 81.87 million shares, and it paid $4 million in cash and issued a $5 million promissory note. It also assumed debt of $4.5 million.

I think this is a good move. The company has been in Florida for a while, but it has no stores open yet. This will give them 26 stores. I continue to believe that the company will do very well if Florida voters vote for adult-use legalization in November. It will take a margin of 60%, and it’s not clear when this will be implemented if they approve it. I am concerned that Florida’s medical cannabis program has hit maturity. BDSA reported a record low estimate of 1.8% sales growth for the state in March. The state releases data weekly, and it has shown that unit growth, which is higher than sales growth, has slowed. The medical patient growth is still positive, but is the slowest ever.

Planet 13 surprised investors with a capital raise in March. It sold 18.75 million units at $0.60. The units included a share of stock and a warrant at $0.77. On the Q4 conference call, management recognized that it may have been poor timing, but the company thought it made sense to have more capital. The stock had crashed when the deal was announced, and it is lower now than before it was announced. It did rally after the DEA potential rescheduling news hit the media on April 30th to about $0.80, which was above the price before the deal was announced.

The Planet 13 Outlook Is Solid

As I said above, there is just 1 analyst covering the stock. There is an estimate for 2024, but it may be stale, as it hasn’t changed recently. The single analyst, according to Sentieo, is projecting 2024 revenue will grow 46% to $144 million. Adjusted EBITDA is expected to be $18 million, which would be a margin of just 12.5%. Note that this estimate was ahead of the Q4 and the Q1 report and doesn’t include the addition of VidaCann.

The company hasn’t provided any historical data, but data from the state indicates that the VidaCann sold 5.7 million mgs of THC products in the week ending 5/2. It also sold 3.9 million ounces of cannabis in smoking form. Its 26 stores represent about 4% of the state’s open dispensaries, which makes it #9 in the state by store-count. If VidaCann does 2% of the state’s revenue, it did $4.5 million in March. This works out to over $50 million a year. On the Q1 call, Planet 13 management revealed that it was doing $8 million per quarter through the first three quarters of 2023. I look forward to learning more, as it appears that the revenue at Planet 13 could increase well beyond what is currently expected by the analyst.

For now, I will take a guess and assume that VidaCann will add $50 million of revenue in 2024. Florida, which is pretty much fully a grow-it and sell-it market (fully vertically-integrated), has higher margins than other states, and I am assuming a 20% adjusted EBITDA margin, which would be $10 million in 2024. I am using $11 million for 2025 (assuming no adult-use), to get a full-company projected adjusted EBITDA of $29 million.

Planet 13’s Chart Is Attractive

While American cannabis operators are up a lot in 2024, Planet 13 has dropped 3.3%. The New Cannabis Ventures American Cannabis Operator Index has rallied 29.5%, but it’s not just that sub-sector that is performing well. The New Cannabis Ventures Global Cannabis Stock Index has gained 27.1% so far in 2024. Planet 13 is down slightly in 2024:

Schwab

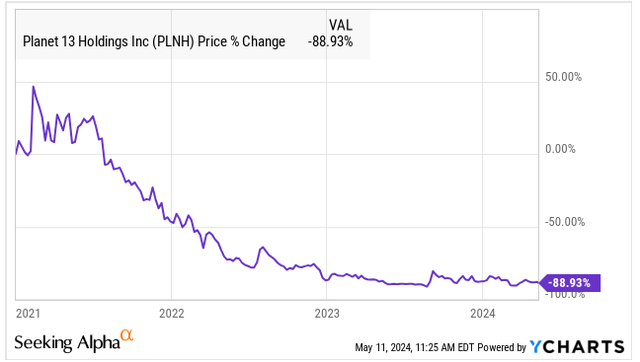

As I stated above, the stock gapped down when it sold units in March, and it filled that gap ahead of the DEA news that was released on 4/30. The stock posted an all-time low in August ahead of the news that the DEA had received a request from the Department of Health & Human Services to move cannabis from Schedule 1 to Schedule 3. It is up since then, but only by about 30%. It’s almost 50% below the 52-week high that was set in early September. The stock is down almost 89% since the end of 2020:

YCharts

I think this chart looks promising. It made a new all-time low and is higher now. It was disrupted by a capital raise, but it seems to be settling down. I see good support at the $0.60 area.

Planet 13 Can Rally

For targeting Planet 13 price at the end of 2024, I would like to use the projected adjusted EBITDA for 2025, which would be a year ahead. My own projection, ahead of the VidaCann acquisition, was that revenue would expand 15% to $166 million. My own estimate was that the company could generate adjusted EBITDA of $23 million, which would be 14% of revenue. My target ahead of the closing was based on an enterprise value to projected adjusted EBITDA for 2025 of 8X.

Adding in the shares issued to VidaCann holders, the share-count is now 325.2 million. Adding in a small amount of RSUs, this rises to 325.5 million shares The warrants could become an issue, as there are 18.75 million at $0.77. Planet 13 has not provided an outlook for its legacy operations or how they might change with VidaCann. They have also not discussed the impact of the merger on tangible book value. Ahead of the deal, the stock was trading at 1.5X tangible book value.

Using my projected adjusted EBITDA for 2025 of $29 million and an enterprise value of 8X would suggest $232 million. This would suggest a stock value of $252 million, which works out on the new share-count to be $0.77, which is the exercise price of the warrants coincidentally. This would be a gain of 24%.

I think that my outlook is conservative and that the stock could rally a lot more, especially if Florida approves adult-use. If the debt-free company were to attain a multiple of 10X instead of 8X, the stock would rally more. The share-count with the exercise of the warrants would rise to 344.3 million, and net cash would increase too. I am getting a stock price of $0.94 in that scenario, which would be 52% higher.

Conclusion

I find Planet 13 to be at a very attractive valuation with a good chart too. I like that it is small and can expand, as it is doing in Florida. I also like that it is a clear leader in Nevada. The stock isn’t widely followed by investors or analysts, and this could be an opportunity too.

The reason that American cannabis companies have done so well in 2024 is the progress with the potential rescheduling. I don’t believe that Planet 13, with its very strong balance sheet, will be the biggest beneficiary of 280E going away, but it will benefit. With that said, there is still a chance that rescheduling doesn’t take place.

There are other risks that Planet 13 faces too. It is trying to get back the cash that was taken from it, and it may fail to do so. The current balance sheet does not include this cash. M&A is another risk, and the company may fail to properly integrate VidaCann. I am concerned about the medical cannabis market in Florida, as I described above.

My Beat the Global Cannabis Stock Index model portfolio currently has a 12.7% position in Planet 13. I increased the position this week ahead of the report and then afterwards too. The stock is part of the index I am trying to beat, and it carries a weighting in it of 3.5%. PLNH is currently the fourth largest position of the 8 names I hold. My other model portfolio, Beat the American Cannabis Operator Index, has a 24.1% exposure. That index has about 8% exposure to the stock. So, I am very exposed to Planet 13.

I see upside to Planet 13, but it is the very limited downside that appeals to me. It is the only MSO that is debt-free, and it trades at a very low multiple to its tangible book value (before the acquisition). The company is the leader in Nevada, and there is growth potential in California, Illinois and now Florida. M&A is a tough concept in the cannabis industry, but I can see a larger MSO attempting to buy this company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment