Source: C.Aphirak / Shutterstock.com

Marijuana has been in the news recently amid the U.S. Department of Justice’s proposal to reschedule the drug. However, Canadian cannabis producer Village Farms (NASDAQ:VFF) has been booming largely on its own strengths. Earlier this month, the company posted strong results for its first-quarter earnings report. In addition, VFF stock appears to be signaling a potential breakout move.

According to Benzinga, total revenue for the three months ended March 31, 2024 hit $78.1 million. That’s up from $64.6 million in the year-ago quarter. Further, gross profit hit $15.5 million, an improvement over last year’s print of $12.3 million. On the bottom line, consolidated net loss came in at $2.9 million, a favorable outcome compared to Q1 2023’s loss of $6.6 million.

Notably, the company’s Canadian cannabis unit (under the Pure Sunframs and Rose LifeScience brands) saw net sales rise by 49% to $37.4 million. That was a big leap from the $25.1 million posted in Q1 of last year. Moving forward, management is eyeballing international expansion, particularly in Germany.

On a year-to-date basis, VFF stock is now up over 59%. However, shares have been steadily fading since early April, warranting a closer look.

Village Farms and the Bullish Flag

Although President Joe Biden administration’s initiative to downgrade marijuana to a lower enforcement classification initially lifted cannabis stocks, the upswing hasn’t been linear. With the inability to sustain momentum, cannabis players may be suffering from the buy-the-rumor, sell-the-news effect.

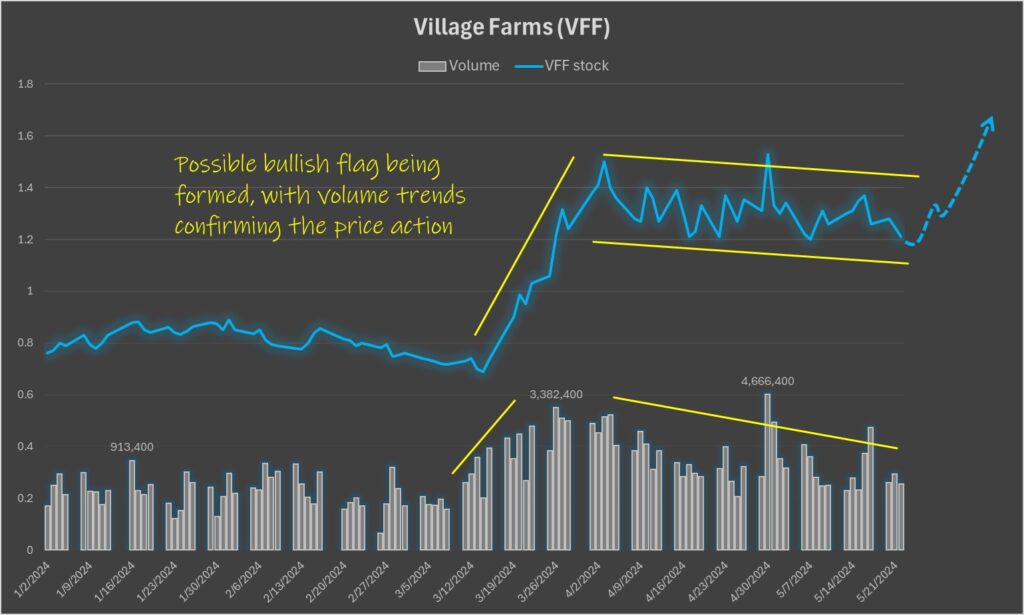

VFF stock jumped from a closing price of 69 cents on March 14 to $1.50 on April 3. Aside from a pop to $1.53 on April 30 – when the Justice Department announced its reclassification plan – Village Farms shares have been noticeably fading in a negatively tilted trend channel. Ordinarily, such a framework would seem negative for the bulls.

However, it’s possible that VFF stock could be charting a bullish flag formation. If so, the fading trend that we see now might only be a temporary consolidation prior to a big breakout move.

Former Merrill Lynch director John J. Murphy wrote in his book, Technical Analysis of the Financial Markets, that the bullish flags “usually occurs after a sharp move and represents a brief pause in the trend. Volume should dry up during the formation and build again on the breakout.”

That’s mostly what we’re seeing with VFF stock, making it ripe for contrarian trade.

Trade of the Day: Buy VFF Stock in the Open Market

With the above framework laid out, Thursday’s trade of the day is a simple one: Buy VFF stock in the open market before it breaks out of its consolidation pattern. While it’s a high-risk trade, investors are signaling that a big move is about to materialize. While Wednesday’s session saw a loss of nearly 3%, the afterhours session saw a jump of over 4%.

For those who are curious, options are available for VFF stock. However, engaging the derivatives route is probably not a good idea. With limited participation, the bid-ask spreads are incredibly wide. For instance, the 21 June 2024 $1 call featured a bid of 20 cents and an ask of 45 cents, yielding a spread of 75.76% as represented by the midpoint price (33 cents).

For the out-of-money (OTM) $2 call with the same June 21 expiration date, the bid is zero and the implied volatility (IV) is 0%. Essentially, the market maker doesn’t want to touch this trade unless the counterparty wishes to accept extremely unfavorable terms.

Of course, if VFF stock breaks out of the consolidation pattern, the options chain should see greater activity. For now, though, the most straightforward approach is to simply bet in the open market, banking on the bullish flag holding true.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Be the first to comment